UPDATE: #CALIFORNIA Insurance Dept. publishes *final* avg. gross 2026 #ACA rate filings: +10.1%, down slightly from 10.2% preliminary:

"Nearly 10 babies died for every 1,000 live births. For Black babies, it was even higher at 15.2. The numbers — the highest in more than a decade — led the state of Mississippi under Edney's leadership to declare a public health emergency on Aug. 21."

#PublicHealth #healthcare #medicaid #ACA #insurance #InfantMortality #ChildrensHealth #hospitals #RuralHealth #ReproHealth #ReproJustice #pregnancy #prenatal #mississippi

FUCK MIKE JOHNSON.

Republicans are terrorists. The US does not negotiate with terrorists.

Johnson says ACA negotiations can't happen until the government reopens

https://www.msnbc.com/msnbc/news/johnson-aca-democrats-shutdown-trump-rcna235706

#Shutdown #ACA #Obamacare #Medicare #Medicaid #MikeJohnson #RepoublicanTerror #USPol

📣 NEW: In which I finally put that absurd 2013 WSJ graphic to good use.

2026 #ACA Window Shopping is LIVE in Georgia, Idaho, Nevada, New York and Virginia.

Here's how much premiums will ACTUALLY spike for 4 households starting January 1st if they don't shop around.

https://acasignups.net/25/10/05/which-i-finally-put-absurd-2013-wsj-graphic-good-use

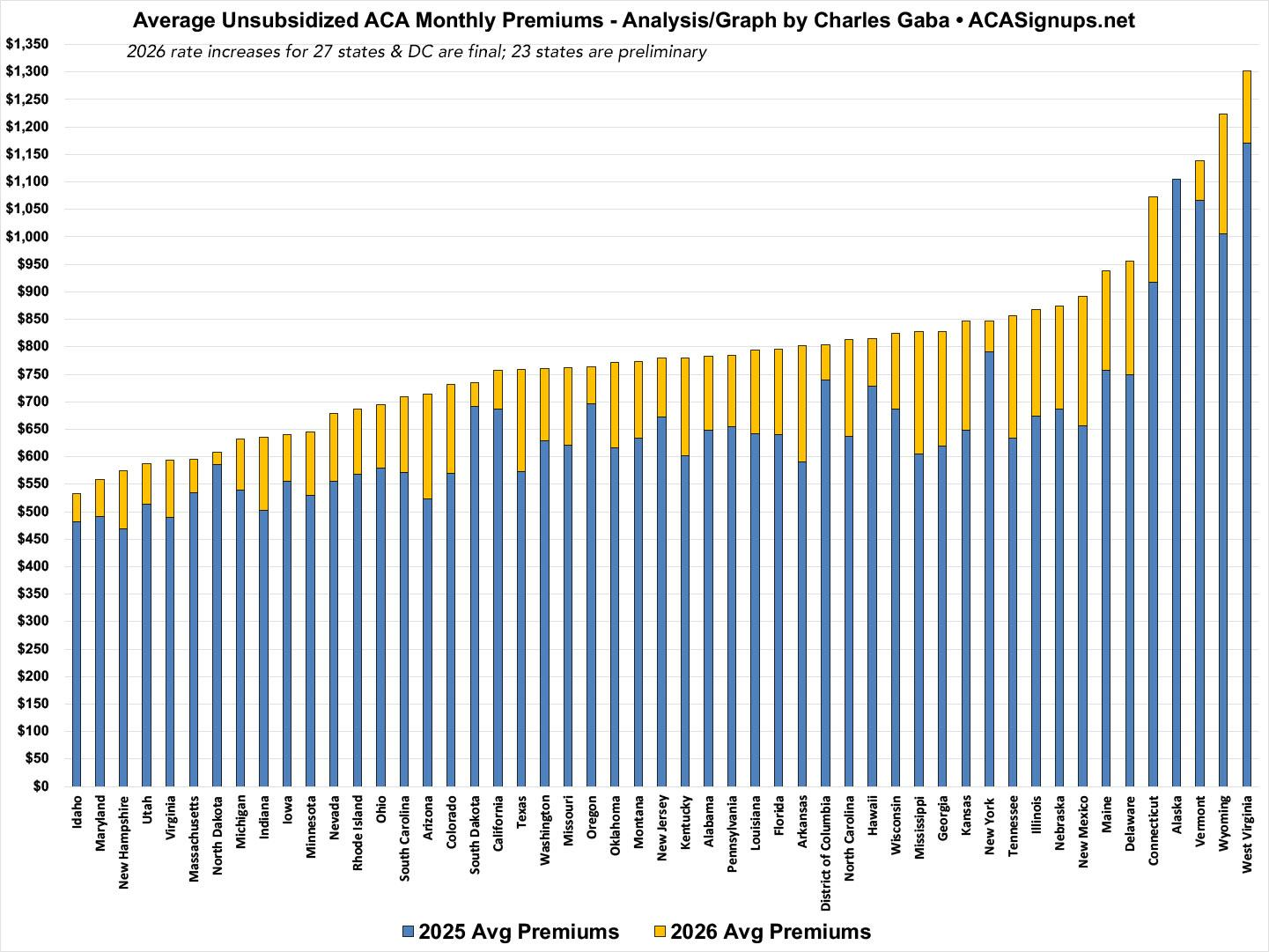

📣 UPDATED: With 28 states now having submitted their FINAL 2026 #ACA rate filings, here's what avg. *gross* monthly premiums look like for every state.

Lowest: Idaho ($533/month)

Highest: West Virginia ($1,302/month)

These are without *any* financial assistance.

"Nearly 10 babies died for every 1,000 live births. For Black babies, it was even higher at 15.2. The numbers — the highest in more than a decade — led the state of Mississippi under Edney's leadership to declare a public health emergency on Aug. 21."

#PublicHealth #healthcare #medicaid #ACA #insurance #InfantMortality #ChildrensHealth #hospitals #RuralHealth #ReproHealth #ReproJustice #pregnancy #prenatal #mississippi

IOWA insurance regulators issue FINAL avg. gross 2025 #ACA rate changes: +15.3%

Again: That's for *unsubsidized* enrollees; NET rate hikes will be much higher for the vast majority of enrollees.

📣 UPDATED: Two new polls confirm: Out of the gate, Americans STRONGLY support extending the #ACA tax credits.

🚨 Meanwhile, 58% of enrollees barely knew about the looming danger as of a week ago.

Washington Post Poll: Out of the shutdown gate, Americans *strongly* support extending the enhanced #ACA tax credits:

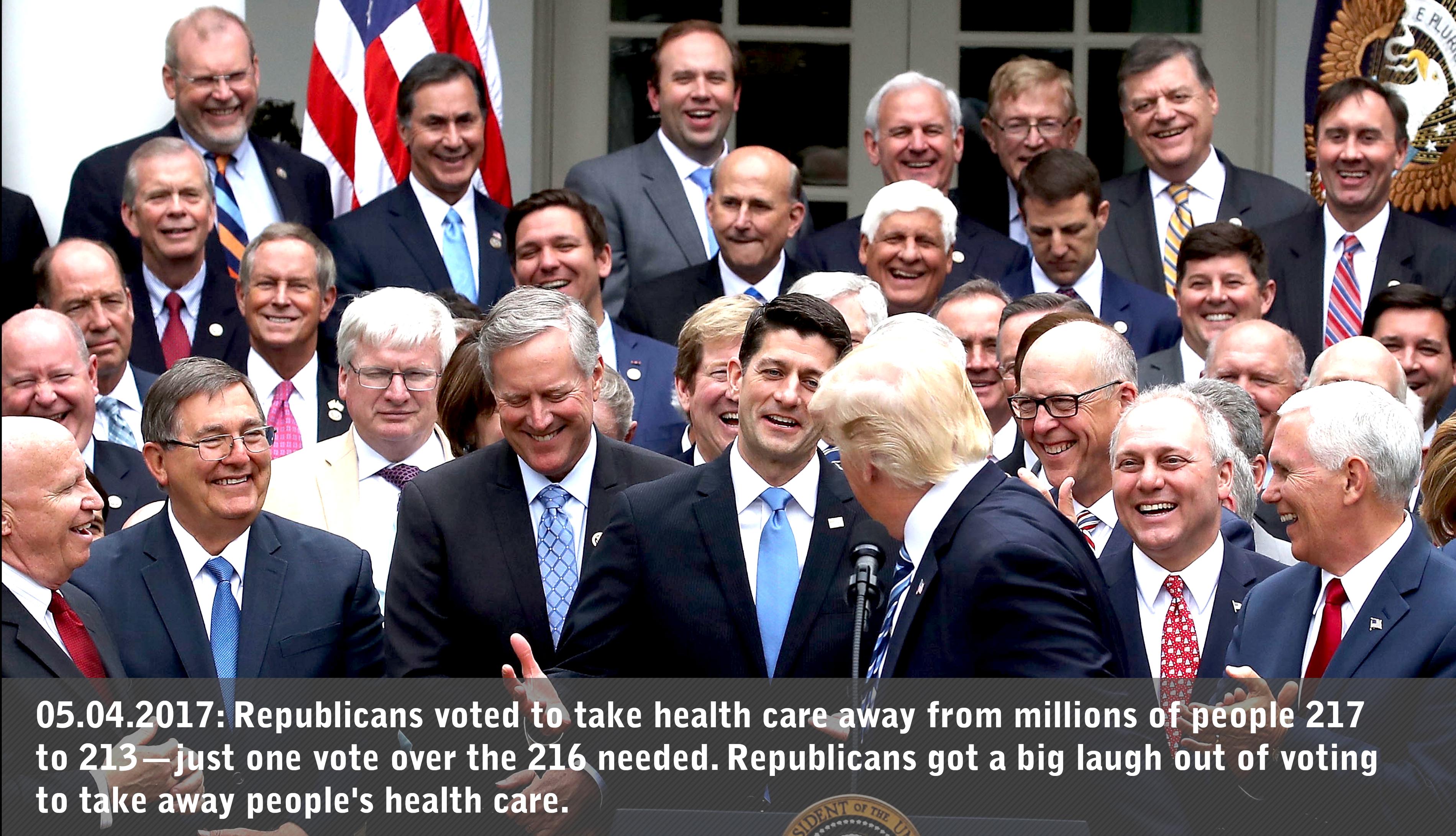

There are few things funnier to Republicans than taking away healthcare from millions of Americans. They've tried to end Obamacare FIFTY TIMES.

#Healthcare #Obamacare #ACA #TrumpDidThis #RepublicansDidThis #GOPKakistocracy #AmericanFascistParty #Project2025 #NoRepublicansEverAgain #USPol

IDAHO: Final gross avg. 2026 #ACA rate changes: +10.5% (updated)

The good news is that the Minnesota Commerce Dept. has published the final avg. 2026 #ACA rate filing decisions.

The bad news is that avg. full-price premiums are increasing by *more* than initially projected...22.1% vs. 16.9%.

🚨🚨 114% is the new 75%: As I warned in July, net #ACA rate hikes will increase EVEN MORE if the improved tax credits expire due to the Trump Regime changing the PAPI formula: