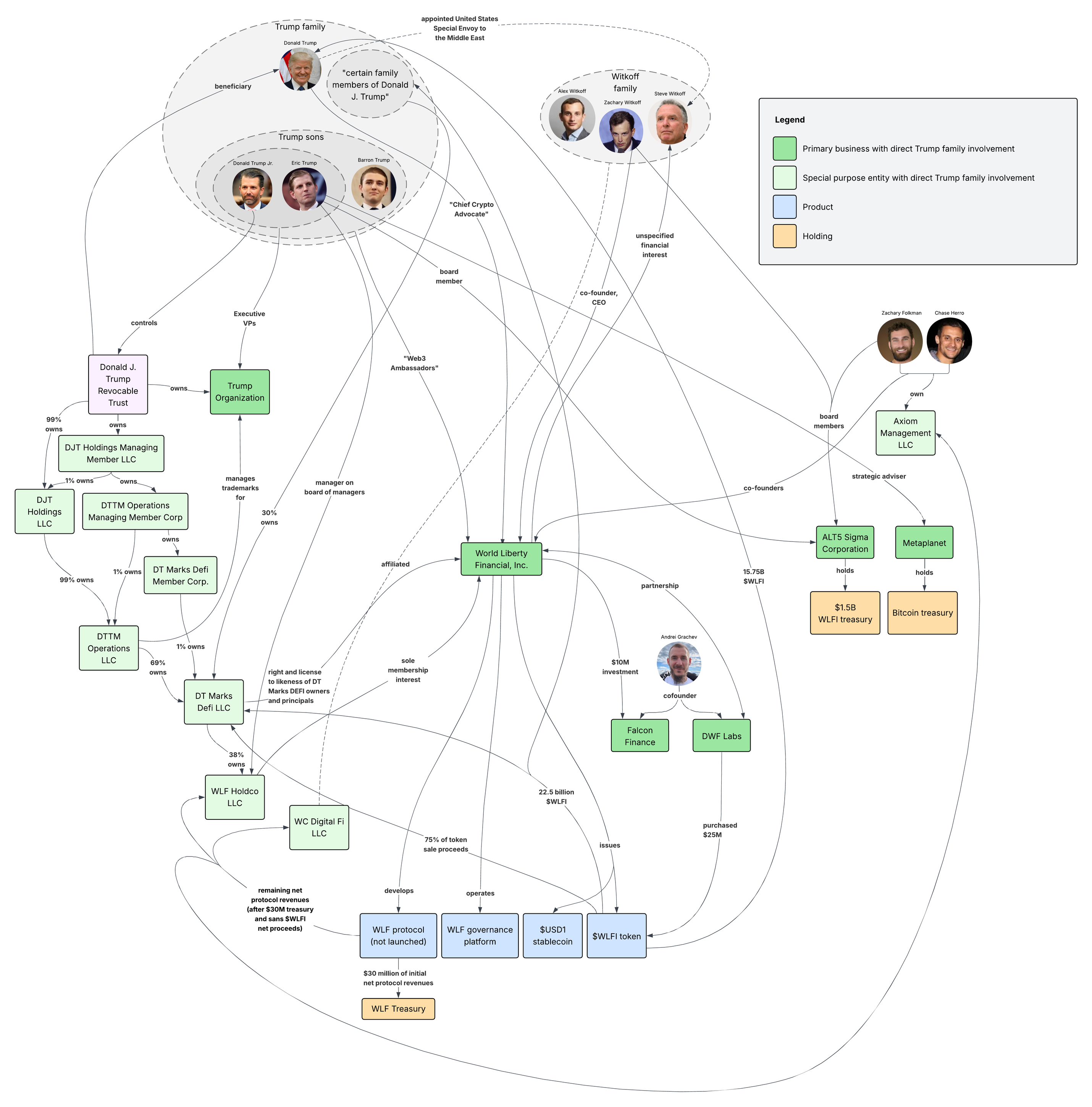

The second deal is an agreement to supply a substantial number of advanced computer chips to Emirati AI firms, including G42 — chips which had previously been restricted due to national security concerns. Just as the UAE’s massive USD1-denominated deal was highly lucrative for the Trumps, this chip deal will be highly lucrative for the UAE and the royal family.

The links between the two deals are numerous. Trump and Steve Witkoff have been involved in both World Liberty and in the UAE chip deal. Steve Witkoff is close with Marty Edelman, who serves as general counsel for G42, one of the Emirati technology firms that will receive a substantial portion of the chips. AI and Crypto Czar David Sacks was also a key part of the chip negotiations, despite his own conflicts of interest surrounding the AI industry, in which he and his firm are heavily invested. The UAE has invested in Sacks’ Craft Ventures firm, from which Sacks has not divested. Craft Ventures also invests in BitGo, the crypto company that provides custody services for World Liberty Financial’s stablecoin. A top employee of G42 is simultaneously “chief strategic adviser” to World Liberty. The MGX firm, which made the $2 billion Binance investment, was established with help from G42, and the two firms share a chairman in Sheikh Tahnoon. Zach Witkoff, a co-founder of World Liberty, has described Sheikh Tahnoon as “a close family friend”.

A White House official has described the Times story as “fake news”, a

![After Coinbase was hit with a lawsuit from Oregon’s Attorney General, who argued that “states must fill [the] enforcement vacuum being left by federal regulators who are abandoning [crypto enforcement] cases under [the] Trump administration” [I82, 85], Coinbase has sent a letter to the Department of Justice asking them to pressure Congress to enact “broad” federal preemption provisions for cryptocurrency markets. They also argue the DOJ should lean on the SEC to issue rules excluding digital assets from securities laws. Besides the list of cases and cease-and-desist orders against Coinbase under state securities laws, they also protest state-level crypto licensing regimes (like New York’s BitLicense). They write, “In signing Illinois’s law just last month, Governor J.B. Pritzker made clear that the law aims squarely to undermine what he called the federal government’s efforts to ‘actively deregulat[e] the crypto industry.’” [I91] Heaven forbid any states should obstruct the deregulation that crypto spent so generously to secure!](https://media.hachyderm.io/media_attachments/files/115/267/223/896/471/163/original/3b779a738dbc4a72.png)

![Trump business interests

The New York Times published a story on September 15 highlighting the “extraordinary” “confluence” of two business deals, in which Trump and various White House officials appeared to trade access to US computer chips to the United Arab Emirates for personal profits from World Liberty Financial. (The Times was careful to note that “there is no evidence that one deal was explicitly offered in return for the other.”)

They’re referring to the $2 billion investment by the Emirati MGX into Binance, which was denominated in USD1, the stablecoin issued by the Trump family’s World Liberty Financial business [I83]. The New Yorker estimated that Trump and his family will personally profit around $168 million from this deal alone if the assets remain in USD1 through the remainder of Trump’s term.1 In addition to the Trump sons’ direct involvement, Zach Witkoff is CEO and a co-founder of World Liberty. He’s also the son of longtime Trump ally and now Special Envoy to the Middle East, Steve Witkoff, who himself was also involved in World Liberty early on. The company claimed in May that he was “in the process of fully divesting from WLFI”, though he continued to have an unspecified financial interest in the company at least as of August.](https://media.hachyderm.io/media_attachments/files/115/267/187/974/957/952/original/46bc442584ee4d7e.png)

![In elections and political influence

A new pro-crypto super PAC has added itself to a rapidly growing list. While 2024 was dominated by Fairshake and its Defend American Jobs and Protect Progress partisan arms, several new crypto PACs have emerged ahead of the midterms, apparently looking to split from Fairshake’s nominally unpartisan approach [I91]. The newest is called the Fellowship PAC, and it says it has more than “$100 million committed” for pro-crypto candidates — nearly as much as Fairshake spent in the 2024 election cycle. Though it has been somewhat tight-lipped on strategy, an announcement document signaled frustration with Fairshake, asserting that “Unlike past political efforts, the Fellowship PAC’s mission is defined by transparency and trust, ensuring political action directly supports the broader ecosystem rather than narrow or individual interests.”11 The PAC has not yet filed any reports beyond a statement of organization, and so its donors are not yet known.12

The Kraken crypto exchange has also ramped up its political spending, announcing a $1 million contribution each to the new Digital Freedom Fund PAC and America First Digital dark money group. Both are pro-crypto groups, and are explicitly Trump- and Republican-aligned.13](https://media.hachyderm.io/media_attachments/files/115/267/220/219/976/194/original/b568828b281c8f7b.png)

![Letters have been absolutely flying out of Congress. Following reports5 that Binance is nearing a deal with the Justice Department that would allow them to escape the oversight of a compliance monitor years ahead of schedule, Senator Elizabeth Warren and others sent another letter to Attorney General Pam Bondi requesting information about “the Trump Administration’s interactions with, and relationship to, Binance and its employees”. They criticized Bondi for a belated and partial response to a May letter inquiring about Binance’s compliance with its plea agreements, pardon discussions between Binance and DOJ officials, and business deals between Binance and the Trump family’s World Liberty Financial, writing that the DOJ had “fail[ed] to meaningfully answer any of our questions” [I44, 83, 91].6

Warren and seven other members of Congress have also sent a letter to White House Special Advisor for AI and Crypto, David Sacks, inquiring as to whether he has exceeded his 130-day limit as a Special Government Employee. They note that there are “more flexible ethics requirements” for SGEs because of the limited work period, and that Sacks enjoys that flexibility as he simultaneously serves as a General Partner at his Craft Ventures fund.7](https://media.hachyderm.io/media_attachments/files/115/267/212/856/794/461/original/5d71672a2d6e3302.jpg)